With open enrollment getting underway, we surveyed 545 consumers who shopped online for health or Medicare insurance on our exchange over the past 12 months. The goal? To learn as much as possible about what these consumers are looking for in a health plan and how they like to shop.

Our survey revealed a number of key insights about Medicare shoppers that carriers can use to guide them through the 2021 open enrollment season. Here are four key insights:

1. One-third of insured consumers who shopped over the past year will be in the market for a new plan over the next 12 months

We found that 33% of surveyed health insurance and Medicare consumers who shopped over the past year are expecting to be in the market again for a new plan over the next 12 months. This presents a major opportunity for Medicare carriers, who should be ready to pursue these shoppers in the coming months.

2. Medicare shoppers spend more time deciding on a policy than health insurance shoppers

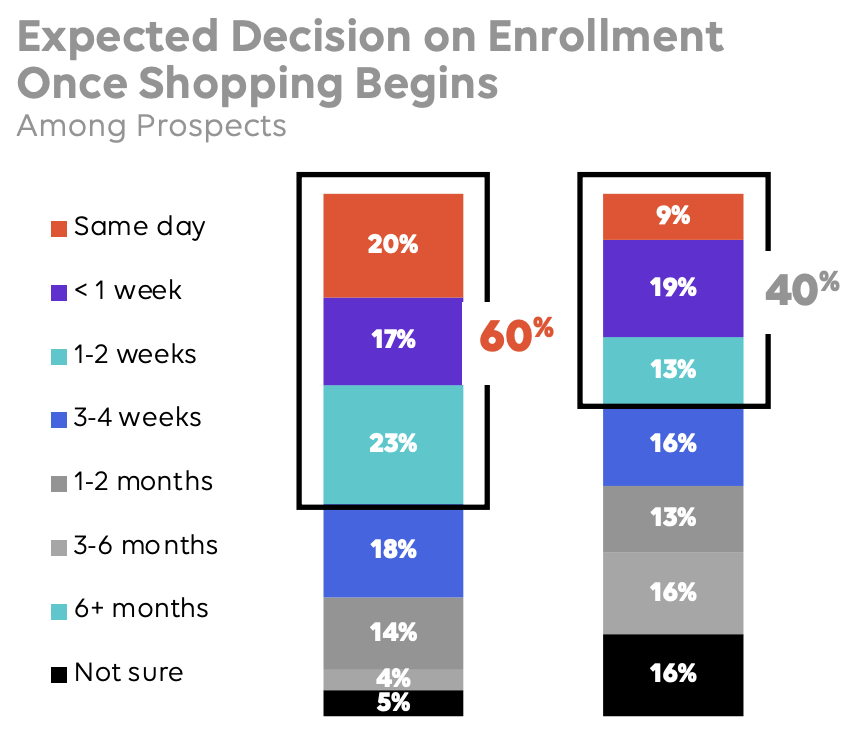

Another thing we discovered is that Medicare shoppers take more time finding a policy than health insurance shoppers. Just 40% of surveyed Medicare shoppers expected to make an enrollment decision within two weeks of beginning their shopping, as compared to 60% of health insurance shoppers. Meanwhile, 44% of Medicare shoppers are expecting to receive quotes from three or fewer carriers before purchasing a policy, as compared to 52% of health insurance shoppers.

For Medicare carriers, this longer sales cycle means it’s a good idea to maintain a lead nurturing program that enables you to remain in touch with the consumer via text, email, and telephone. This way, when they’re ready to make a purchase, you’re still top of mind.

3. Better coverage was the number one driver of Medicare shopping

More than any other factor, Medicare consumers cited the desire for better, more comprehensive coverage as the reason they were thinking of switching plans. Indeed, a whopping 74% said it was their number one concern. In order to woo these consumers, it’s a good idea to highlight the depth and breadth of your coverage in your marketing messages.

4. Medicare shoppers prefer a personal interaction

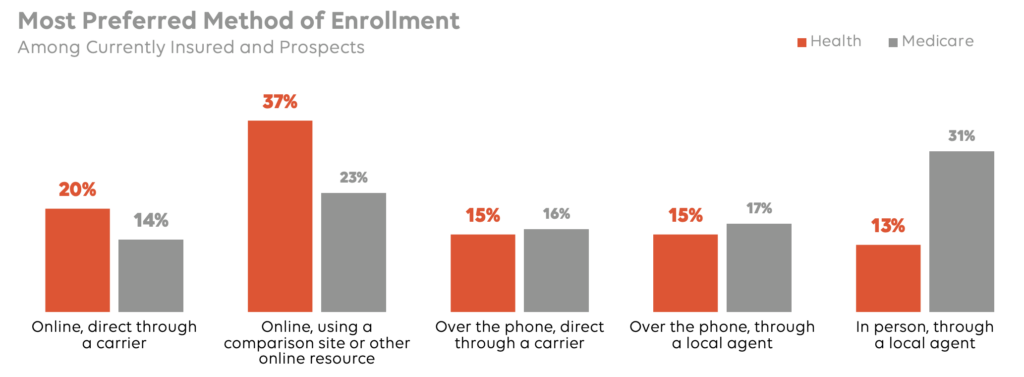

While Medicare shoppers have become more comfortable shopping online, 64% still prefer to enroll via a personal interaction with a representative or agent of the carrier. In order to cater to shoppers with a variety of preferences, it’s best to make sure your website gives clear options for the consumer to continue their purchase journey online or over the phone.

Want to learn more about Medicare shoppers? We’re happy to share.

As Medicare carriers dive into the open enrollment period, it’s crucial to know as much as possible about what your target consumers are looking for and how they like to shop.

If you’d like to see the full results of our survey, or to learn more about how best to cater to the preferences of this year’s Medicare shoppers, reach out to your MediaAlpha account manager today. And if you’re not already a MediaAlpha client, you can always schedule a meeting with us on our website to learn more about how we can help you improve customer acquisition performance.