Auto insurance agencies are small businesses, first and foremost. And when you’re running a small business, you have to think carefully about every one of your costs. That’s why agents are some of the most prudent spenders around, and why many of them use the lead cap feature on our platform to place a limit on the number of leads they purchase each day or week. After all, it’s important to stick to your budget and prevent your customer acquisition spending from exceeding what you can afford, right? Well, not exactly.

Auto insurance agencies are small businesses, first and foremost. And when you’re running a small business, you have to think carefully about every one of your costs. That’s why agents are some of the most prudent spenders around, and why many of them use the lead cap feature on our platform to place a limit on the number of leads they purchase each day or week. After all, it’s important to stick to your budget and prevent your customer acquisition spending from exceeding what you can afford, right? Well, not exactly.

What many agents miss is that when you’re acquiring customers profitably, you don’t have to worry about overspending. That’s because when you have a positive return on investment from your lead-buying, you’re more than replenishing the money you spend on each new lead with the commissions you’re earning from each new sale. Indeed, when you’re approaching customer acquisition the right way, you can grow your business most effectively by purchasing as many leads as you can get—so long as you’re buying them at a price that’s less than your return on investment.

For example, if every lead costs you $10 and delivers an average return on investment of $13, it doesn’t matter how many leads you buy—you’re always going to be generating a profit as you continue buying leads. And if you place an artificial cap on your lead-buying, you could find yourself missing out on great new customers who wind up binding with one of your competitors, instead.

Here are four steps you can take to uncap your growth while acquiring new customers profitably:

1. Determine how much profit you earn from each new customer you acquire

The first step to ensuring profitable customer acquisition is to get a sense of how much the average new shopper is worth to your business. This means reviewing your book of business to see not just what your customers pay in premiums each month, but how much you can expect to earn in commissions from your average customer over the lifetime of your relationship with them. This includes analyzing how long a customer typically stays with you after you acquire them and any commissions you receive every time they renew.

So, if you know that the average new customer pays you $50 in commissions per year and stays for 2.5 years, you can assume that the lifetime value of each new customer you sign up is $125. This would mean that if you’re paying anything less than $125 to acquire each new customer, you’re earning a profit.

2. Review your conversion rate and additional acquisition costs to get a sense of how much you should pay for each lead

The MediaAlpha for Agents platform enables you to pay what you want for online insurance leads via our automated delivery auction. When you set your bids for different kinds of shoppers inside our platform, you can determine exactly how much you’re going to pay for each new lead.

Once you have a sense of your desired cost for acquiring each new customer, you can start figuring out your bidding strategy. In order to do this, you need to analyze how frequently you’re able to convert the leads you buy and take note of any additional costs you incur while working them. For instance, if you pay producers to work your leads or if you give them a commission when there’s a new sale, you’ll need to factor that into your final calculation, as well.

So, let’s say you’ve deduced that each new customer is worth $125 to your business and you give a $25 commission to your producer for each new sale—that leaves $100 in your pocket from each sale. If you convert 10% of the leads you buy, that means every tenth lead you buy is going to convert into a sale. So, as long as you’re paying less than $10 per lead, you’re going to come out ahead by spending less than $100 for each new customer you acquire—no matter how many leads you buy.

3. Work with your MediaAlpha client success representative to accurately price different consumer groups

Of course, not all leads will have the same value to your business. Certain kinds of consumers will be more likely to convert for you after you contact them, or more profitable to your business once you’ve signed them up.

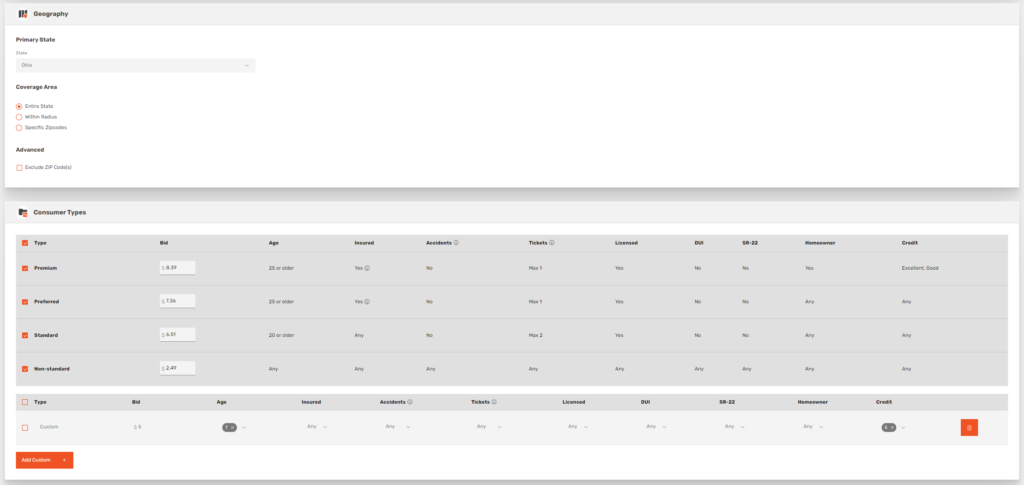

In order to account for these differences, you can assign different bid values to different kinds of customers in the MediaAlpha for Agents platform, based on their age, currently insured status, driving record, and more. For instance, if a certain kind of shopper is worth twice as much as the average consumer to your business, you might increase your bid from the $10 maximum we discussed earlier to $15.

Here’s what it looks like in the platform:

If you’re looking for help creating your bidding strategy, your MediaAlpha for Agents client success manager can provide guidance. They’ll be able to help you analyze your past business results, as well as provide important insight into the state of play in the overall online insurance lead marketplace. This way, you can get a sense of what different kinds of shoppers will be worth to your business, as well as what those shoppers are typically worth at auction.

4. Review your performance and optimize your lead-buying accordingly

Even the most finely tuned bidding strategy requires regular monitoring and adjustment to continue delivering results. Maybe certain kinds of shoppers that used to convert frequently for you are no longer converting, or perhaps a certain portion of your customer base is starting to show signs of greater retention.

By continuously reviewing your performance and adjusting your bids, you can ensure that your customer acquisition strategy is set up for long-term profitability.

Want more advice for achieving uncapped customer acquisition growth? Check out our Agent’s Guide to Online Leads.

By optimizing your lead-buying strategy for profitability, you can remove your lead caps and give yourself the room you need to maximize your business growth—without placing an artificial limit on how many new customers you can acquire.

If you’d like to learn more about how to make the most of your lead-buying, our Agent’s Guide to Online Leads is full of best practices for targeting the right shoppers, bidding the right price, and working your leads to perfection.

And if you have any additional questions, your client success manager is more than willing to lend a helping hand—all you have to do is reach out to schedule a meeting. Of course, if you’re not yet a MediaAlpha for Agents partner, you can always set up a time to learn more about what we have to offer on our website.