Recently, we discussed how savvy auto insurance carriers are offsetting their marketing costs by serving ads to their website visitors who are ineligible to purchase a policy from them.

But while this tactic is a powerful tool for generating new revenue and scaling your customer acquisition operation, you’re still leaving lots of money on the table if you’re not also showing ads to some of the visitors who are eligible to purchase a policy from you—but who are unlikely to do so. Indeed, even after you monetize ineligible site visitors and converting customers, you’ll still have plenty of people leaving your website without contributing a single cent to your bottom line.

At this point, you’re probably asking a rather urgent question: “If I show ads for other carriers to my eligible site visitors, won’t that cannibalize my policy sales?”

The answer is no, and the reason is predictive analytics. By analyzing your historical conversion data and creating a predictive model, you can identify the site visitors who are most and least likely to purchase a policy from you. If a certain group of customers is technically eligible to bind but highly unlikely to do so, you can often make more money by serving them an ad. And if a group of customers is likely to buy from you, you can always show them an ad-free experience that clearly pushes them toward purchasing a policy.

Ultimately, the benefit of predictive analytics is that it gives you the information you need to make intelligent monetization decisions and maximize the value of every customer interaction—regardless of whether that value comes from an ad click or a bind.

That’s a pretty big benefit. In fact, several of the industry’s leading carriers are already using predictive analytics to recoup a whopping 20%-30% of their digital marketing costs. This revenue can be kept as pure profit, or pumped back into the customer acquisition funnel to increase scale.

Want to learn more about how predictive analytics can make your business more profitable? Keep reading.

5 Reasons to Display Ads to Eligible Site Visitors with Predictive Analytics

When we first started speaking with carriers about serving ads to eligible customers, many of them were understandably hesitant. Certainly, a bind generates a whole lot more money than an ad click, and insurers are in the business of selling policies, not ads.

But when we dive a little deeper, the logic for predictive analytics is quite compelling. Here are five reasons why:

1. Your site visitors are shopping—if you don’t monetize them, someone else will. According to a JD Power report, the average auto insurance shopper requests 3-4 quotes before purchasing a policy. This means you’re unlikely to be the last stop for most of your visitors. It’s up to you to decide whether to monetize their next action with an ad, or to let Google keep the profits when the user returns to the search engine in pursuit of another quote.

2. Carrier site ads are extremely valuable. As we discussed in an earlier blogpost, your site is home to a highly desirable audience that other carriers will pay a premium to reach. Your high-intent, data-rich visitors are in-market for a policy, and they’ve already filled out a form that includes valuable information about where they live and what kind of household they’re in. The most expensive carrier site ads are sold for more than $100 a click.

3. Unlike policy sales, ads are pure profit. When you sell a policy, there’s always going to be costs associated with the bind, such as insurance claims and loss adjustment expenses. But ad sales are pure profit, and you get paid in full upfront. Ask yourself: “How much new premium revenue would my company have to generate to deliver $5 million in incremental profit?”

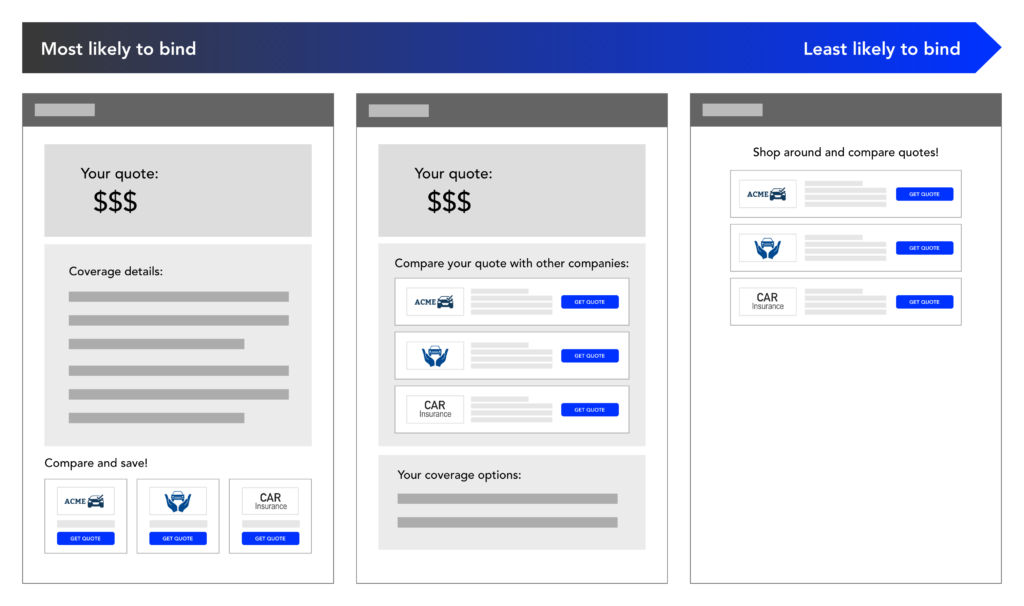

4. You can show the right experience to each user. Serving ads isn’t an all-or-nothing thing, and the best carriers employ a gradient of user experiences to maximize performance.

Say your data analysis has identified a group of visitors who are fairly likely to bind. You could show these shoppers a page where your quote is in a prominent position and the ad is lower down the page, where the user will only see it after they’ve viewed the quote. Conversely, if a group of visitors is fairly unlikely to purchase a policy, you might show them a prominent ad followed by your own quote lower down on the page.

Here’s an example of what this gradient might look like:

5. Serving ads doesn’t mean you won’t get the sale. Since insurance is a high-consideration product, consumers sometimes continue looking for the best deal even if they like what you have to offer. We see instances where a customer clicks an ad on a carrier page, gets a quote from a competitor brand, and returns to the initial carrier to bind. One carrier even saw an increase in conversion rates after it started serving ads to unlikely customers. We can hypothesize that the carrier may have earned consumers’ trust by demonstrating that it was willing to display other offers.

Good data, the right partner, and a test-and-learn attitude: what every carrier needs to get predictive analytics right

Some of the industry’s most advanced carriers are already using predictive analytics to generate incremental profit and scale their customer acquisition efforts.

If you’re ready to join them, here are the four things you need to get started:

1. 24 months of historical business data

Quality predictive analytics requires about 24 months of historical quote and conversion data, with insight into variables such as source of traffic, customer age, and monthly premiums. Getting this data isn’t always easy, and you may have to work across teams and systems in your company to get it.

2. A predictive model

Predictive analytics requires carriers to first create an algorithm that can predict the likelihood of a user binding based on 80% of their historical conversion data. If the model is able to accurately rank the remaining 20% of users by their likelihood to convert—that is, if the visitors the model predicts to be likely customers do actually convert at a higher rate than those predicted to be less likely customers—then you have an effective, highly differentiating model.

If you don’t have the expertise to produce a model in-house, the right technology partner can help.

3. A willingness to test and learn

Predictive analytics delivers results right off the bat, but maximizing performance takes patience and consistency. To achieve peak efficiency, you’ll need to continue analyzing your results and updating your model accordingly.

4. The right technology partner

Rather than working blindly with an off-the-shelf solution, you’ll find more success with a hands-on technology partner who can help you find a nuanced approach that fits your specific customer base and business needs.

Starting maximizing the value of your website audience today

If you like what you’re hearing, give your client success representative a call or schedule a demo to start generating new revenue through the power of predictive analytics.

Our team is looking forward to helping you analyze your data, create a predictive model, and maximize the value of every customer interaction.