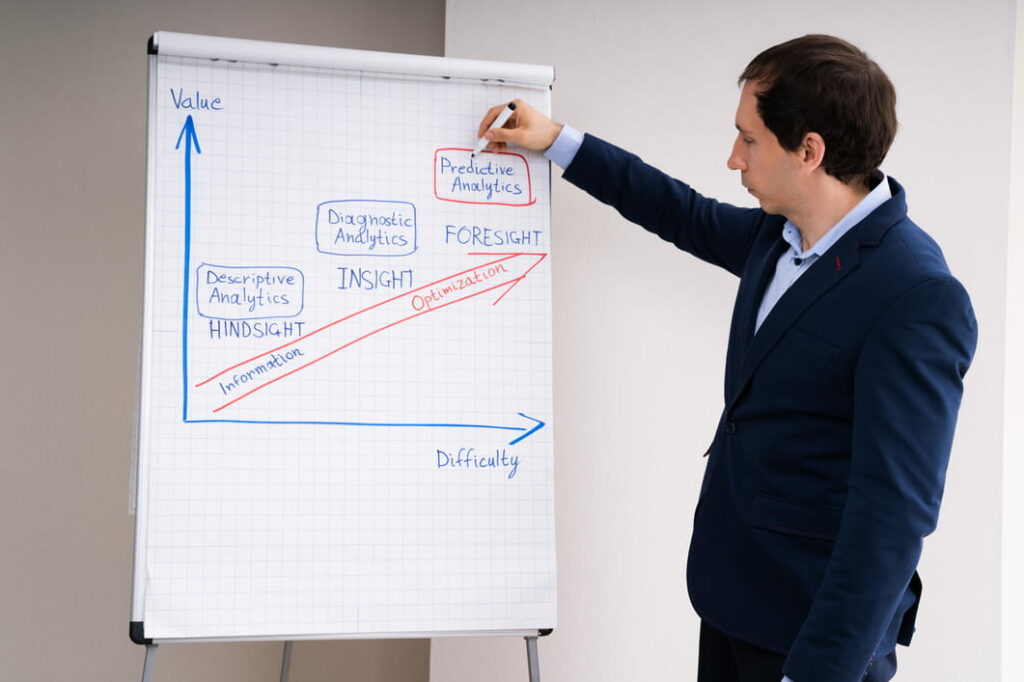

Predictive analytics is a powerful data science technique that can help insurance carriers predict how likely each one of their website visitors is to purchase a policy. With these insights, insurers can give each shopper a customized, Predictive Experience designed to generate the greatest possible revenue from every single site visitor.

It may seem counterintuitive, but one of predictive analytics’ greatest strengths is its ability to help you identify the website visitors who are least likely to buy a policy from you. By comparing the demographic, behavioral, and contextual characteristics of a given website visitor to the consumers you’ve engaged in the past, your predictive model allows you to confidently forecast when a shopper is highly unlikely to bind.

Rather than allowing the shopper to leave your site without contributing to the bottom line, you can use Predictive Experiences to generate new revenue from your least likely customers—sometimes millions of dollars annually. Here are three ways to accomplish this:

1. Refer shoppers to another brand under your corporate umbrella

If your carrier has other brands under its corporate umbrella, you can use this synergy to maximize your company’s profits and better serve your website visitors who are highly unlikely to convert. The way to do this is by redirecting shoppers to one of your sister brands when you can’t offer them a policy or when your model tells you they’re unlikely to bind with you.

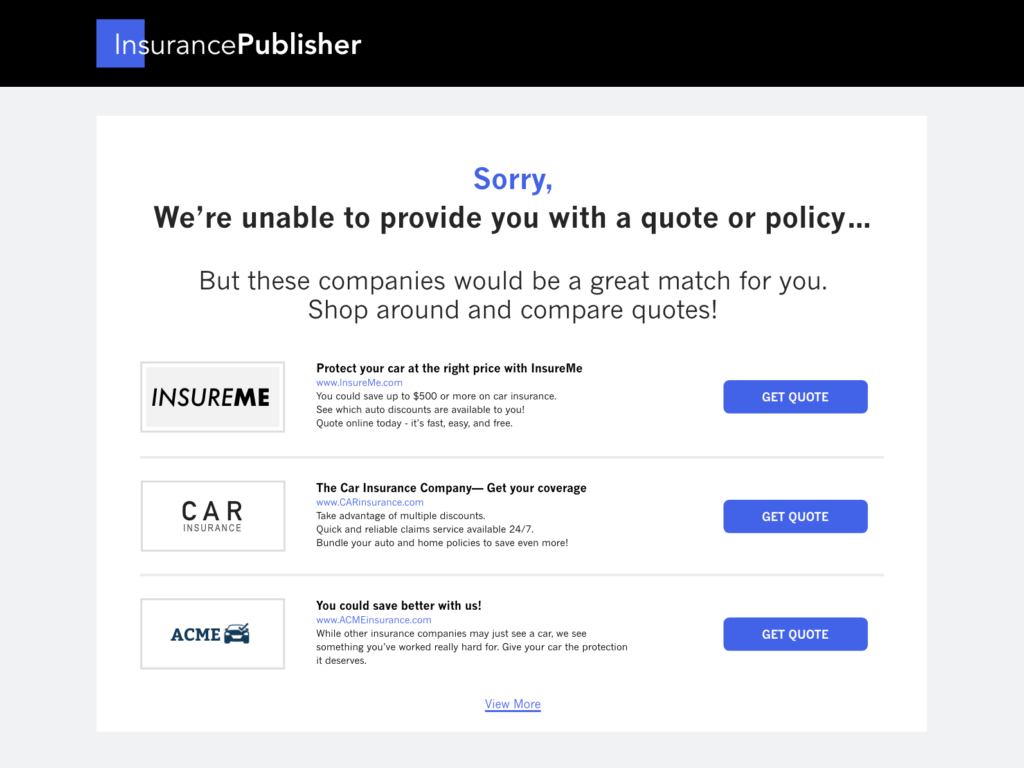

If you can’t write the consumer a policy under any circumstances, you can show them listings for your other brands instead of a quote. Here’s what it could look like:

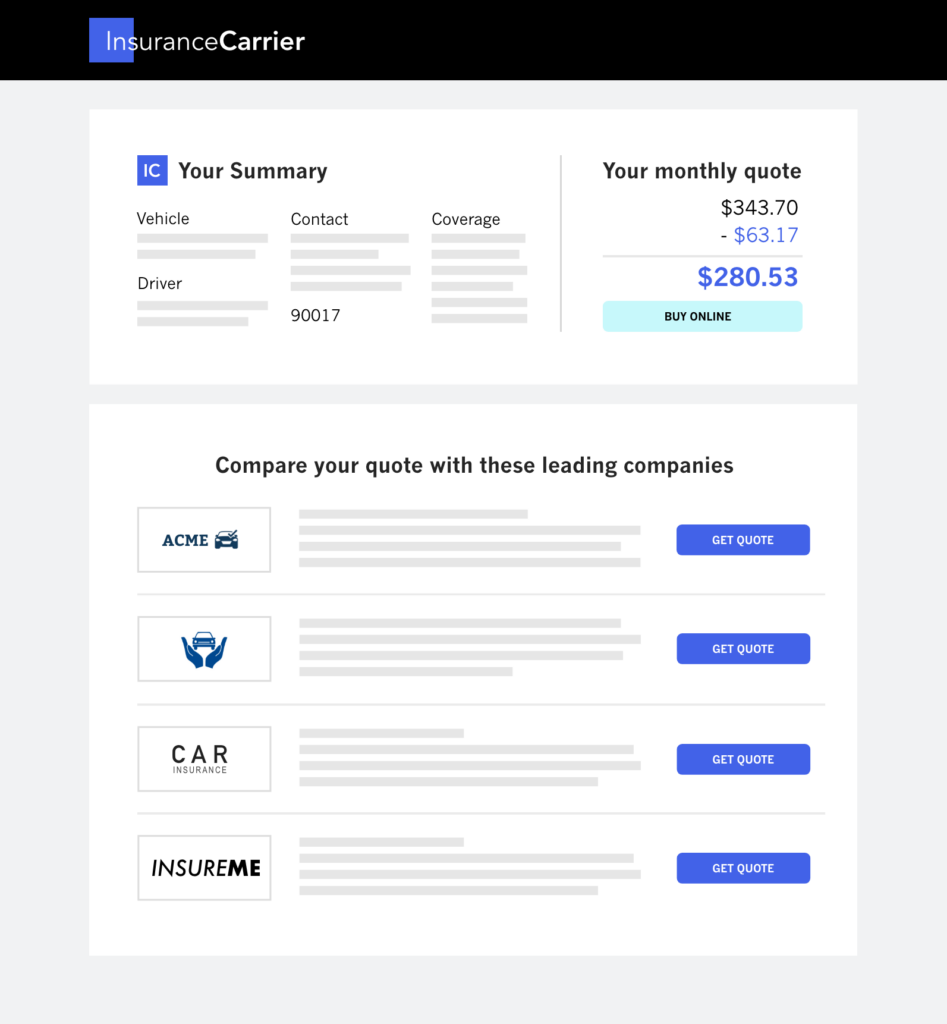

If you technically can write the consumer a policy, but your predictive model tells you that they are highly unlikely to purchase one, you can show them listings for your sister brands alongside your own quote. Here’s what it might look like:

In addition to helping you generate additional sales for your parent company, this tactic creates a better user experience for the shopper, who can easily continue their search for a policy by clicking one of your listings.

2. Decide whether to sell a lead or remarket to consumers who don’t bind

Predictive analytics can also help you make smarter decisions about what to do when you offer a shopper a quote and they don’t purchase a policy right away.

If your predictive model indicates that the shopper is fairly likely to bind, you probably want to find another way to connect with them and sell them a policy. This could mean having an agent or call center representative call them on the phone, send them a follow-up email, engage them in a text message conversation, or a combination of the three.

On the other hand, your model might tell you that a shopper is highly unlikely to purchase a policy, even after repeated follow-ups. In this instance, you might choose to earn some additional revenue by selling the consumer as a lead to a lead aggregator.

3. Monetize unlikely customers with alternative listings for other carriers

This option is similar to showing listings for the other brands under your corporate umbrella. The difference is that you’re showing listings for carriers outside your company and earning a referral fee every time a consumer clicks a link to visit another carrier. While it might seem counterintuitive to refer your website visitors to another company, there are some instances where it could be the right decision for you—particularly when the shopper is unlikely or ineligible to purchase a policy from one of your sister carriers.

By using a predictive model, you can sell these clicks for six to 10 times as much revenue as you would otherwise be able to earn from selling stale leads after you finished remarketing to them. In fact, some carriers have used this tactic to generate revenue equal to 20%-30% of their overall annual digital marketing costs—that’s millions of dollars each month. You can retain these referral fees as incremental revenue that you return to the bottom line, or you can reinvest them into customer acquisition so that you can bid more aggressively for new customers.

Want to learn more about how Predictive Experiences can boost your customer acquisition? Read our new whitepaper.

These are just a few of the ways that Predictive Experiences can help you generate tens millions of dollars in new annual revenues from the consumers who are already on your website. In our new whitepaper, we dive deep into how to create a predictive model and how to apply it in a way that enables you to maximize the value of every website visitor.

And if you’re not already a MediaAlpha customer, you can always schedule a meeting with us on our website to learn more about what we can do to take your customer acquisition to the next level.