Welcome to Stats Spotlight, a new feature where we provide an interesting statistic for insurance advertisers.

Welcome to Stats Spotlight, a new feature where we provide an interesting statistic for insurance advertisers.

Having the right measurement tools in place is an absolute must for property and casualty insurance advertisers who are looking to maximize their customer acquisition performance. Without them, you won’t be able to accurately assess your performance or identify areas for improvement. This leaves you with very little opportunity to intelligently adjust your bidding strategy for greater performance moving forward.

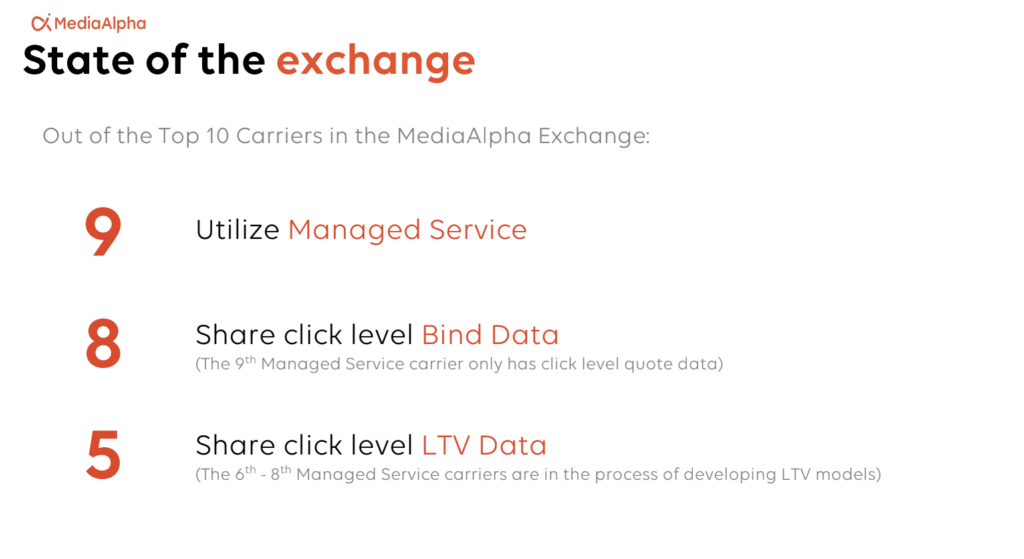

Today, we’ll look at one crucial tracking tool that many insurance advertisers have yet to implement: lifetime value tracking. This tool determines how much money each consumer you’ve acquired is worth to your business over the course of your relationship with them. Right now, just five out of the top 10 carriers on our platform are sharing click-level lifetime value data with us. The rest are unable to measure or optimize their bidding for lifetime value.

Crucially, sharing click-level lifetime value data enables you to analyze the lifetime value of different kinds of customers using a powerful metric known as lifetime value-to-customer acquisition costs (LTV-to-CAC). This metric compares the lifetime revenue you receive from your customers to what you paid to acquire them. This way, you can determine which kinds of shoppers are most valuable to you—and thus worth raising your bids to acquire more of—and which ones you’re overspending for.

LTV-to-CAC is the most sophisticated and effective way for carriers to optimize customer acquisition performance. A necessary first step is to connect your marketing data to your sales data with our conversion tracking token. This enables you to see which ad clicks led to which sales, as well as to measure your cost-per-bind. While cost-per-bind is superior to the flawed cost-per-quote metric because it takes your actual policy sales into account, it doesn’t consider the difference in revenue you earn from different kinds of shoppers the way LTV-to-CAC does.

Want to learn more about customer acquisition measurement? Let’s chat.

If you’re looking to go deeper with customer acquisition measurement, our team of hands-on industry experts is always happy to help. Simply set up a meeting with your account manager to learn more. Or, if you’re not already a MediaAlpha customer, schedule a time to speak with us on our website.