For several years, insurance industry observers have discussed the rise of the so-called “insurtechs,” a growing class of technology companies that use data science, digital technology, and artificial intelligence to help consumers find and purchase the policies that are right for them.

But heading into 2022, these insurtechs are not merely “on the rise.” Rather, they are established, serious players in the online customer acquisition marketplace and real threats to the legacy carriers they compete with for online customers. Though these companies can not yet match the scale of their legacy counterparts, they have several built-in advantages that more established brands need to be aware of as they bid against them for high-intent online shoppers.

Here are four things legacy carriers need to know about their emergent insurtech competitors—and what they can do to maintain their positions.

1. Insurtechs are taking a growing portion of the customer acquisition pie

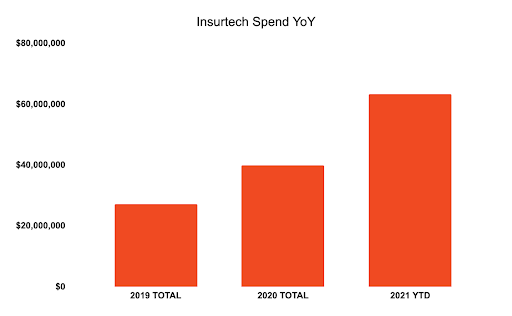

Insurtech customer acquisition spending has grown considerably over the past several years, and these firms are starting to take an increasingly significant slice of the marketplace.

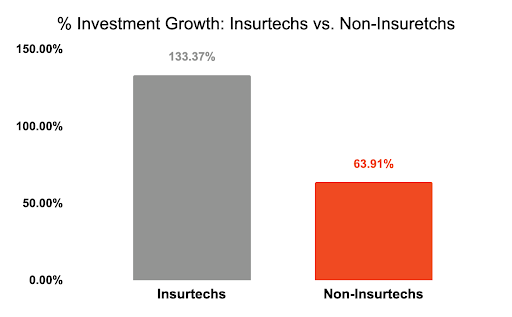

If you look at the top 50 advertisers on the MediaAlpha exchange, the insurtech companies on the list spent 133% more in our marketplace during the first three quarters of 2021 than they did in all of 2019. This rapid growth in spend has outpaced the growth of legacy carriers and cut into their dominance over the marketplace. So far this year, insurtechs have accounted for 12.2% of all spending from top-50 advertisers on the MediaAlpha exchange—up from the 7.5% they were responsible for during the first three quarters of 2019.

2. Insurtechs are able to continue growing due to their equity models

Though insurtechs are smaller than their more established rivals, they’re able to punch above their weight due to their equity models.

By raising money from investors, these well-capitalized companies are able to invest heavily in customer acquisition. Over the past several months, we’ve seen Jerry raise an additional $75 million and Insurify raise an oversubscribed $100 million round. Expect these brands and others to continue increasing their customer acquisition spend as they exchange equity for greater funding.

3. Insurtechs’ online-first user experiences make it easier for consumers to bind

Insurance technology companies have another advantage in the way their focus on digital has created high-quality online shopping experiences that drive conversions.

For these companies, the shopping experience takes place mostly—or entirely—online. As a result, they’re able to focus primarily on delivering seamless, user-friendly website experiences that make it as easy as possible for the consumer to find and buy a policy online. By contrast, legacy players must also focus on the consumer experience across the offline touchpoints where they sell policies.

In order to keep up, legacy carriers will need to make sure their own online shopping experiences are up to snuff. This means introducing online binding features that allow consumers to purchase policies without leaving the browser window, as well as implementing pre-filled forms that reduce the amount of time consumers have to spend typing in their information to receive a quote.

4. Insurtechs have an easier time implementing best practices for measurement and optimization

The other big consequence of a digital-first distribution strategy is that it’s much easier for insurtechs to track which online shoppers purchased a policy after clicking one of their ads.

These companies are able to draw a straight line between the consumer clicking an ad to visit their website and completing their purchase online since the two actions are so closely linked. When you know exactly which consumers purchased a policy after clicking an ad, it’s much easier to both measure the impact of your digital marketing on new sales and optimize your bidding strategy for greater performance moving forward.

On the flip side, the consumer’s path to purchase is often more complex for legacy carriers. If a shopper receives a quote online but purchases a policy from a local insurance agent, it takes work to centralize and connect the data from these two touchpoints. Without this link, you won’t be able to detect key trends in which kinds of consumers are and are not likely to buy from you. The end result is that the insurtech companies that have this information are well-positioned to outbid rival carriers for the most valuable consumers on the market, while their competitors are likely to unwittingly overpay for consumers that are less likely to bind.

In order to bid more competitively against these insurtech players, you can integrate MediaAlpha’s conversion tracking token, which enables you to see the anonymized identity of every shopper who purchases a policy from you after clicking on one of your ads. This way, you’ll be able to more accurately measure your success and optimize your bidding based on the real value of each consumer to your business.

Legacy carriers can stay ahead of the curve with better user experiences and more intelligent bidding

As insurtechs grow their investments in customer acquisition and become more sophisticated in their performance optimization, legacy carriers will need to ensure that they are implementing best practices to retain their share of the market. By implementing technology integrations like online binding, pre-filled quote forms, and conversion tracking, you can put yourself in the best possible position to maximize conversion rates and bid competitively as insurtechs continue to scale.

If you’re looking to learn more about the best ways to implement these tools and execute on a more sophisticated, more efficient customer acquisition strategy, we’d love to hear from you. As always, you can reach out to your account manager to set up a meeting. And if you’re not already a MediaAlpha client, you can schedule a time to meet with us on our website.