If you want to improve your digital marketing efficiency, there is no getting around one simple truth: you need to know which of the consumers who clicked your ads went on to purchase a policy.

After all, the whole point of an insurance carrier’s performance marketing operation is to drive sales. Not clicks, not quotes—sales. If you don’t know how many of the consumers who clicked your ads went on to purchase a policy, you can only guess at how well your marketing operation is working. And needless to say, this also makes it quite difficult to determine what you’d need to do differently to raise your performance.

When you can’t connect your policy sales to the online ads that led to them, you’re left with incomplete metrics that fail to tell the full story of your performance and do not provide a roadmap for more efficient marketing moving forward. That’s a big problem.

Pixels are unreliable at tracking conversions and force carriers to rely on flawed cost-per-quote optimization

Right now, a few of the carriers who track online conversions are still using the pixel-based cookie to do so. There are two big problems with this method. One is that pixels are only capable of tracking what the consumer does on a carrier’s website, which means that they don’t track any of the conversions that occur when a consumer purchases a policy over the phone or at an agency office. And the online sales that are captured by the pixel are limited—Mozilla Firefox and Apple’s Safari have removed third-party cookies from their browsers, and Google Chrome intends to do the same in 2023.

The upshot is that if you’re using pixels to track which of your performance marketing ad clicks led to sales, you’re missing out on all of your offline sales and a big chunk of your online conversions, too. Without these details, carriers are often unable to measure and optimize their cost-per-bind, settling instead for less comprehensive metrics like cost-per-click and the deeply flawed cost-per-quote method.

When you optimize for cost-per-quote, your bidding strategy does not distinguish between the quoted consumers who bind and those who don’t. Indeed, plenty of consumers shop casually, requesting quotes from a number of carriers without purchasing a policy in the end. If you’re simply trying to achieve a low cost-per-quote, your model will value the quotes you provide these shoppers exactly the same as those you give to consumers who are highly intent on purchasing a policy.

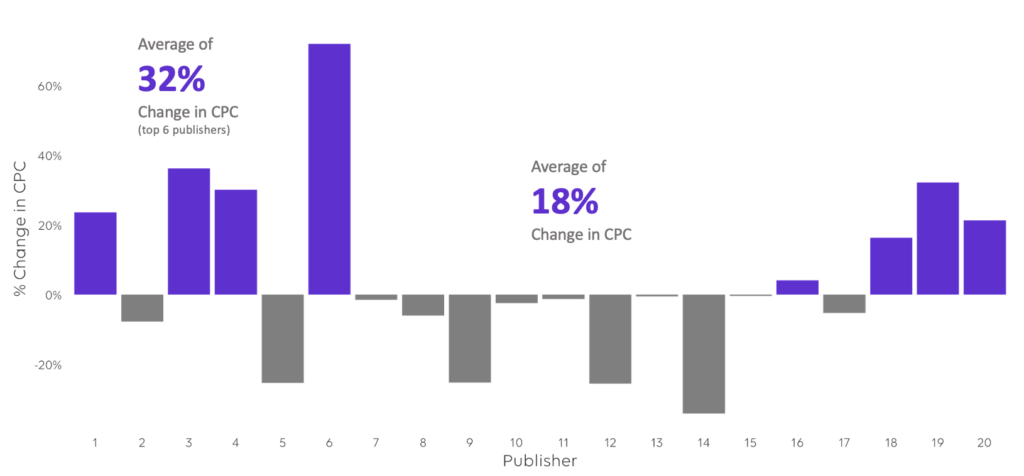

Take what happened when one of our clients started connecting click data to sales data and moved from cost-per-quote optimization to cost-per-bind, as visualized in the chart below.

This carrier saw a significant increase in the cost-per-click it paid its top publishers, and a significant decrease in the cost-per-click it paid to those that drove fewer sales. In essence, the cost-per-bind model enabled the carrier to bid more competitively for the traffic that was actually driving sales, while saving money on inventory that was less valuable to the bottom line.

Our conversion tracking token enables you to optimize for the metrics that matter

One reliable way to upgrade from cost-per-quote is to connect your click data to your sales data with our conversion tracking token.

If you’re unfamiliar, the token is a string of encrypted letters and numbers that gets tacked onto the URL that consumers are directed to when they click on an ad. This enables you to match each ID to the consumer’s corresponding identity inside your customer relationship management (CRM) platform. When you pass the list of converting IDs back to us, we can integrate them into your bidding strategy on the MediaAlpha exchange.

Because the token creates a communication channel between your digital marketing data and the CRM that logs all your sales, you’ll be able to see when shoppers purchase a policy after clicking an ad—even when you close the deal offline. These data points are crucial for understanding which kinds of shoppers are more and less likely to convert for you, enabling you to optimize your bidding and targeting accordingly. If you want, you can even go beyond optimizing for cost-per-bind and start bidding based on lifetime value to customer acquisition costs, a powerful metric that compares the revenue you earn from a customer over the course of your relationship with them to the budget you spent to acquire them.

Because offline sales sometimes take time to mature, the feedback loop you get from your conversion tracking token is not as fast as a pixel that measures actions taken solely on your website. However, when it comes to optimizing performance, accuracy is much more important than speed. And we often find that the trends we discover from conversion data are fairly consistent. If a certain source of traffic is driving sales for you one month, it’ll likely do the same for you in the following month if your spend remains consistent.

Ready to start tracking conversions and driving better performance? Let’s talk.

As carriers continue working to optimize their performance, those that have a conversion tracking token will have a distinct leg up on their competitors that don’t.

When carriers have a conversion tracking token in place, they’re able to detect how likely different kinds of traffic are to convert for them. This information enables them to get more of the most valuable traffic by raising bids, as well as to spend efficiently on less valuable clicks by lowering them. If you’re not able to do the same, you’re likely to be shut out of the auction for the highest-converting traffic segments while overpaying for shoppers who are less likely to bind.

In short, implementing a conversion tracking token enables you to unlock superior optimization through more granular bidding and build a stronger, more efficient digital marketing operation. If that sounds like something you’re interested in, reach out to your account manager to set up a meeting today. Or, if you’re not yet a MediaAlpha client, you can schedule a time to speak with us on our website.