MediaAlpha is proud to offer the industry’s deepest supply of high-quality, in-market insurance shoppers, as well as the most sophisticated tools for precisely targeting and bidding on this traffic. But even among the millions of consumers who are available through our platform each month, there’s one portion of our traffic that stands head and shoulders above the rest. And if you’re not buying it, you’re not maximizing your performance—and you might be losing ground to your competitors who are.

This highly valuable traffic is driven through insurance carrier websites. There, insurance advertisers are able to reach in-market consumers who have already navigated to a carrier’s website, and frequently have submitted information about themselves. Since there are always shoppers to whom a carrier is unable or unlikely to sell a policy, carriers often show alternative listings for other insurance brands that might be better positioned to serve the consumer.

When this happens, these listings are incredibly valuable to advertisers, who can use them to reach consumers who are deep in their shopping journeys. These prospects are the best shot for a brand to sell a profitable policy: they’re actively shopping for insurance and we have learned enough about the consumer to help drive efficient, profitable acquisition for carriers.

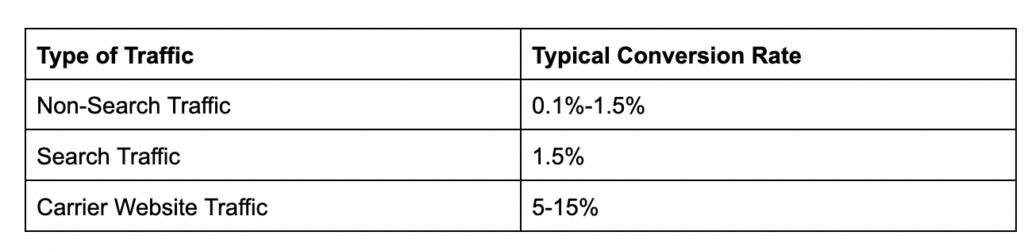

It’s no surprise that this extremely high-intent traffic is the highest-converting segment of shoppers on our platform—usually converting in the high-single digits, and sometimes greater than 10% of the time.

Carrier website traffic enables you to reach data-rich, in-market shoppers who are deep into their shopping journey

If you want to understand why this traffic can be so valuable to you, take a moment to consider the consumer’s journey.

The vast majority of insurance publishers on our platform are comparison shopping websites or lead generators. A consumer might begin their search by typing “find insurance quotes” into Google, and then click a link to a shopping site like OfficialCarInsurance.com or Healthplans.com. Once there, they’ll fill out a form to request a quote and see a list of links they can click to visit one of several carriers to continue pursuing a quote.

The inventory on carrier websites enables you to reach shoppers who are one step further into their journeys. After clicking an ad on an insurance shopping website like the examples above, the consumer will arrive on a carrier’s website. There, they’ll fill out all or part of a quote request form to learn more about the policies they can buy from the carrier.

However, not all consumers are eligible to receive a quote from a given carrier—and many more are eligible to receive a policy but highly unlikely to purchase one from that particular carrier. When carriers can’t or won’t sell a consumer a policy, they work to monetize these visitors by showing them alternative listings for other carriers. Since each business is different, shoppers that are not profitable for another carrier can often deliver a strong return on investment for you.

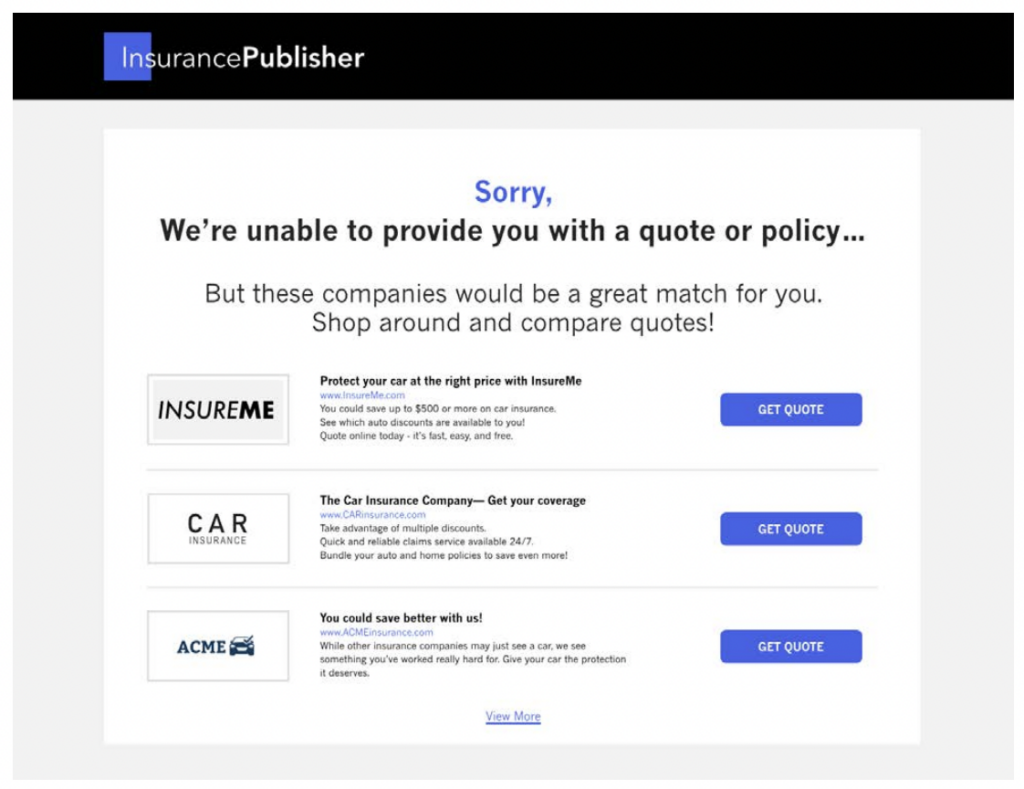

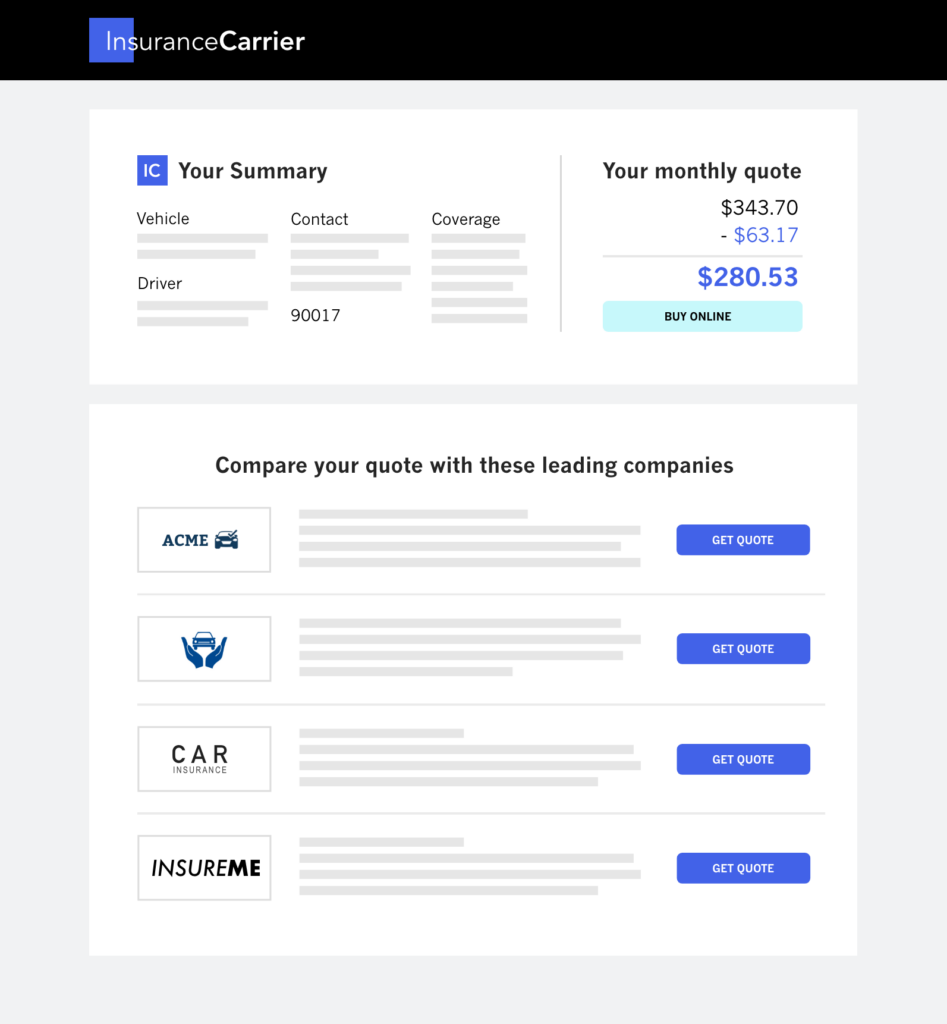

Here’s what the user experience looks like:

When a carrier can’t show the consumer a quote:

When a carrier can show the consumer a quote, but the consumer is unlikely to purchase a policy from them:

As a result, these listings enable you to reach the shopper one step closer to the point of purchase, with the added bonus that the consumer often submits additional quote form information that allows you to target them more precisely.

Here’s a look at how the conversion rates for carrier website traffic compare to other kinds of traffic on our platform:

In addition, these alternative listings provide a great experience for consumers, who can easily click a listing to receive a quote from a carrier that’s a better fit for them. In many cases, they’ll even be able to have their quote form information transferred from the initial carrier after they click the link, enabling them to fill out a streamlined form that already has some of their information pre-filled.

In addition, these alternative listings provide a great experience for consumers, who can easily click a listing to receive a quote from a carrier that’s a better fit for them. In many cases, they’ll even be able to have their quote form information transferred from the initial carrier after they click the link, enabling them to fill out a streamlined form that already has some of their information pre-filled.

MediaAlpha offers more carrier traffic than any other platform, and with more precise targeting and bidding options

If you’re looking to reach these high-intent, high-converting shoppers, the MediaAlpha platform is the best place to do it. Carrier websites were some of the first publishers on our exchange, and we’re proud to offer what is by far the deepest pool of carrier website supply anywhere in the industry. On our platform, advertisers can buy traffic from four of the top six property and casualty insurance carriers, as well as other carriers in the health, life, and Medicare verticals.

We also offer advanced targeting and bidding controls that enable advertisers to target specific pools of each publisher’s traffic. So, not only can you hone in on shoppers who are requesting quotes from Acme Insurance—you can also bid separate prices for different kinds of Acme visitors.

Using the Acme Insurance carrier example, here are some granular bidding strategies you can use:

- Shoppers who live somewhere Acme doesn’t write policies

- Shoppers that Acme will not insure because they believe these shoppers will not be a fit for their business

- Shoppers that Acme will insure, but who are unlikely to purchase a policy from them

This flexibility enables you to bid granularly and connect with each consumer at the price that makes the most sense for your business.

Want to learn more about how to reach and convert high-intent shoppers? We’d love to help.

For insurance advertisers, carrier website traffic offers the opportunity to connect with some of the highest-intent shoppers you can find. And by using the MediaAlpha platform to target and bid granularly, you can make sure you’re acquiring these shoppers as efficiently as possible.

If you’d like to learn more about how you can connect with in-market shoppers who’ve already taken the step of requesting a quote on a carrier website, just reach out to your account manager to set up a time to talk. If you’re not yet a MediaAlpha client, you can always schedule a meeting with us on our website.