As rising loss ratios have caused property and casualty insurance carriers to place a greater focus on profitability during the hard market, many leading brands have sought to cut expenses by reducing marketing spend.

But while these carriers may be looking to limit their spending, a focus on profitability doesn’t mean a turn away from customer acquisition performance. In fact, a number of leading carriers have found that a hard market is actually the perfect time to invest in upgrades that will make their media buying more efficient in the long run.

In baseball, hitters don’t work on their swings during the playoffs—they use lower-leverage periods like spring training to set the stage for strong performance when it matters most. And in our industry, carriers are using the relative down time of the hard market to tackle crucial, in-house projects that enable them to optimize profitability in the short term and maximize growth once the market corrects further down the road.

Here are three ways some of our carrier partners are using the hard market to upgrade their customer acquisition metrics, technology, and bidding strategies:

1. They’re offsetting acquisition costs by monetizing non-converting website visitors

As carriers look to decrease acquisition costs, several have started monetizing non-converting website visitors by showing them alternative providers that might be a better fit. When a shopper clicks one of these links, the carrier gets paid a referral fee—sometimes $100 or more due to the high intent of the consumers who visit a carrier’s website.

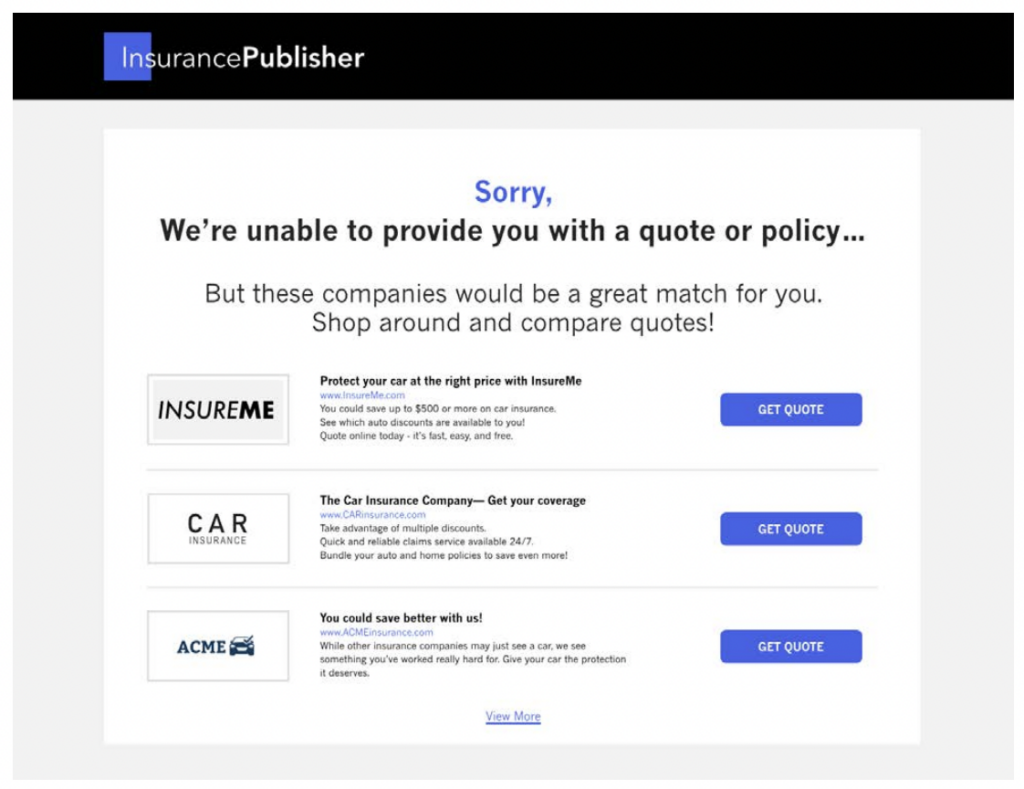

Here’s what it can look like:

The hard market creates a greater incentive to get as much revenue back from your customer acquisition spend as possible, and monetizing non-converting traffic helps carriers earn millions annually from shoppers who otherwise wouldn’t have bought a policy. In addition, carriers have recently stopped pursuing consumer segments that they believe will be unprofitable for them—making it more likely that a consumer who arrives at a carrier’s website will be someone they can’t (or don’t want to) bind.

Carriers have complete control over which consumers see these alternative listings—and how prominently they appear. For example, listings can be shown solely to shoppers that carriers can’t serve (e.g. consumers who live in areas where the carrier doesn’t write insurance, or those who don’t fit their served customer profiles) or those who would be unprofitable on the carrier’s books. Carriers can also use a predictive model to help them identify how likely different kinds of shoppers are to bind with them, based on past results. Then they’re able to use this information to decide whether to serve listings to different kinds of shoppers, as well as optimize how they’re displayed.

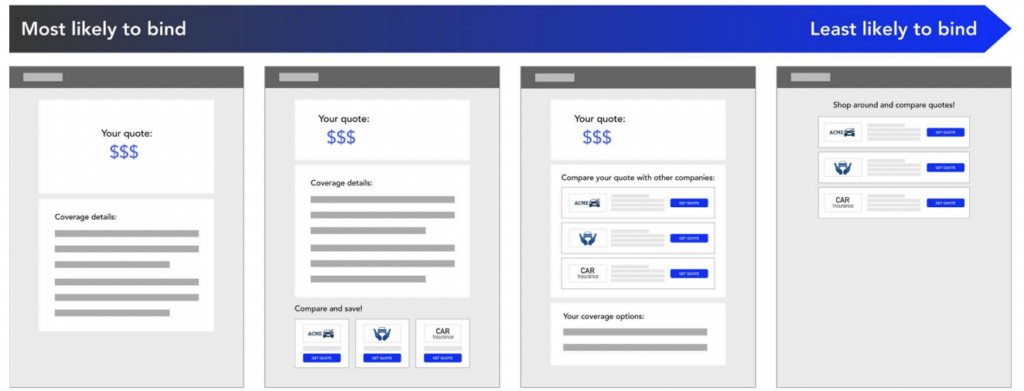

So if a consumer is technically eligible to purchase a policy but highly unlikely to bind, or is likely to bind an unprofitable policy, an insurance brand might show its own quote beside prominent listings for alternative carriers. But if a shopper is among the carrier’s likeliest or most profitable customers, the carrier can choose to show its own quote only, without any alternative listings.

Here’s a range of what these shopping experiences can look like:

2. They’re upgrading the user experience by implementing data passing and pre-filled forms

When you’re spending less time and money on purchasing media and optimizing bids, it’s important to make sure that the shoppers who are still coming to your website are as likely as possible to purchase a policy. And that means upgrading the user experience to make it faster and easier for consumers to bind with you.

One way to do this is by implementing our data passing integration in order to provide consumers with pre-filled forms during the quoting process.

Since the average consumer requests around three quotes before purchasing a policy, it’s possible that a shopper will have already completed several lengthy quote forms on carrier and comparison shopping websites prior to arriving on an insurance brand’s site. When a carrier implements data passing, they receive the information that the consumer submitted on the referring website. They can then use this information to show the shopper a pre-filled quote request form on their site, making the consumer more likely to complete the process and purchase a policy.

Recently, we’ve seen several leading carriers either integrate data passing for the first time, or increase the number of form fields for which they pass data. Since different websites ask shoppers different questions and word those questions differently, increasing the number of fields you pass takes time and development resources. When things are slow during the hard market, it’s a great time to focus on improving the user experience for when customer acquisition is running at full capacity again.

3. They’re maximizing their return on investment by optimizing for customer lifetime value

As carriers pull back on marketing spend, it’s never been more important to optimize bids for customer lifetime value. That is, rather than simply trying to acquire as many new customers as inexpensively as possible, it’s important for carriers to think carefully about how much money they can expect to earn from each shopper over the course of their relationship. If you have $100,000 to spend on digital customer acquisition, you’ll want to make sure you’re getting the $100,000 worth of customers who will be most profitable to your business.

That’s why more carriers are starting to optimize their bidding for a metric known as lifetime value-to-customer acquisition costs (LTV-to-CAC), which compares the total amount of money carriers expect to earn from a customer to the amount of money they paid to acquire them. LTV-to-CAC is important because it takes into account the fact that not all customers are created equal, and someone who is likely to stay with a carrier for 10 years is much more valuable to their business than someone who stays for one.

In recent months, we’ve seen an uptick in the amount of lifetime value data our carriers are passing to us. This allows us to help our partners pinpoint the precise consumer groups who are most likely to be their best customers and assist them in adjusting their bidding to acquire those shoppers efficiently.

Where do you want to be when the hard market ends?

By focusing on efficiency in customer acquisition during the hard market, property and casualty insurance carriers can squeeze every last dollar out of their marketing spend and buoy their profitability during stormy weather.

But what’s just as important is laying the groundwork for maximizing performance when the market turns around. By using the hard market as an opportunity to upgrade measurement tools, bidding strategies, and user experience, savvy carriers will be well-positioned to leapfrog their competitors once the industry goes back into growth mode.