It’s no secret that the past year has been difficult for all of us involved in the property and casualty (P&C) insurance industry. Auto insurance carriers have seen their profitability plummet due to higher costs for car repairs, used cars, and more—all while drivers have returned to the roads at above pre-pandemic levels. In response to this profitability pressure, leading brands have sought to increase their rates while pulling back on variable marketing expenses. Naturally, this so-called “hard market” has had knock-on effects on companies like ours that are in the business of helping carriers acquire new customers.

But for all the challenges our industry has faced this past year, insurance is a cyclical business, with carriers periodically working through similar hard market cycles. Even now, many carriers are already preparing for a return to a growth environment because periods following hard market cycles often present unusually strong opportunities for market share gains.

And once carriers have sufficiently adjusted their rates to the point that they’re ready to start ramping up customer acquisition, we’ll be in a great position to capture their increased marketing investments. Due to our long-standing carrier partnerships, best-in-class technology, and the ongoing secular shift toward direct, digital distribution in P&C, we’re looking forward to a period of major growth alongside our partners.

P&C insurance carriers have overcome hard markets in the past—and when they do, a boom period typically follows

As noted earlier, insurance is a cyclical business. Every now and then, carriers find themselves subject to factors outside their control that cause their loss ratios to rise. Eventually, they adjust their rates to more accurately reflect their risk and expected claims costs, become more profitable, and go back to aggressively competing for market share.

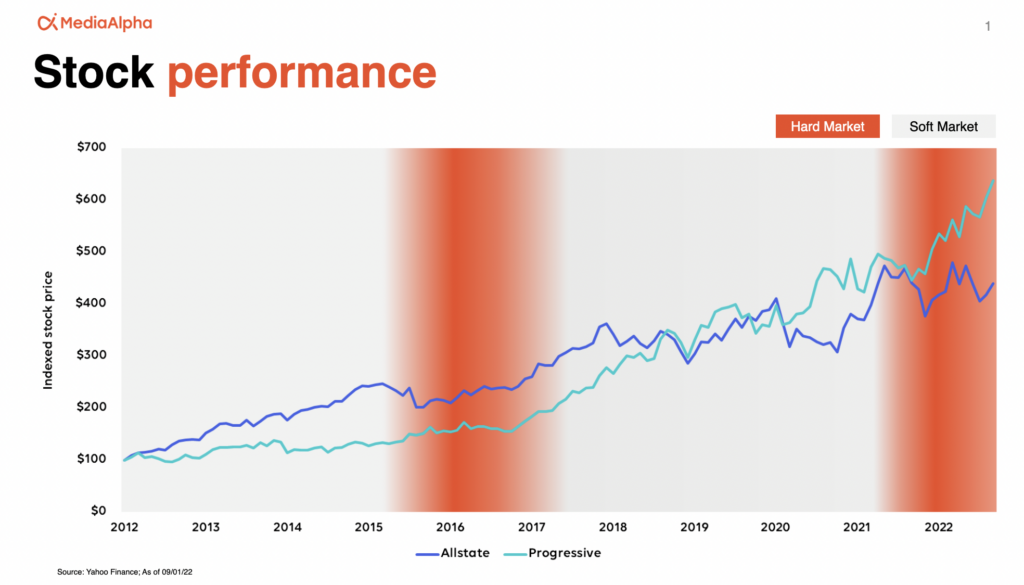

We know this current market environment will soon pass, but don’t just take our word for it, look at how Wall Street tends to respond to these periodic cycles. Even with near-term profitability issues and little or negative growth in policies in force, stock prices for leading carriers like Allstate and Progressive have either remained relatively stable or increased since the beginning of the hard market in 2021. This is similar to what we saw during the last hard market cycle in 2015 – 2017. This is because the market knows that this is all just a part of a temporary cycle.

For instance, the stock prices for Allstate and Progressive crept up steadily throughout the hard market that spanned 2015-2017, followed by a period of extreme growth once the cycle ended.

Throughout the current hard market, top carriers have responded to their rising loss ratios by consistently filing for the rate increases they need to improve profitability and resume the aggressive pursuit of new customers.

As the investment bank Keefe, Bruyette & Woods put it in a note written in August 2022, “We think Allstate and Progressive’s outperformances relative to the S&P 500 reflect investors’ expectation that underwriting margins depressed by rapid claim cost inflation…would

recover as insurers raise rates to absorb the higher loss costs. We broadly agree with

that overall expectation…”

In short, carriers are doing what they need to do to improve profitability and get back into growth mode, and Wall Street trusts that they’ll be back on track before too long.

When top carriers return to growth mode, they’ll be using MediaAlpha to capitalize on the opportunity

The past year has been particularly challenging for us at MediaAlpha. The strange part is that a lot of this has been due to two inherently positive aspects of our marketplace: the flexibility and measurability of our marketing channel. When carriers look to reduce marketing costs during a hard market, digital channels are a convenient place to make cuts because you can increase and decrease spend immediately, as opposed to the television and print media buys that must be made well in advance. And the power of our channel to enable carriers to measure the expected profitability of each new policy sale actually works against us in the current environment, where a significant portion of potential new customers are unprofitable at current policy rates.

Yet despite these headwinds, we know that the flexibility and measurability of our marketplace in turn position us very well to enjoy strong, above-market growth following this cycle, just as we did after the most recent hard market.

For starters, we’re in the midst of a secular shift toward direct distribution, with consumers increasingly likely to purchase policies directly from carriers online. Direct personal auto premiums grew by 7.8% to 32.6% of all personal auto premiums in 2021. By 2026, S&P Global Market Intelligence expects that the direct channel will account for 39% of the market. An example of this shift can be seen in what’s happened at Allstate over the past several years. Under the company’s Transformative Growth Plan that began in 2019, Allstate has more than doubled the share of its personal auto premiums that come through the direct channel, from 16% to 36%.

Meanwhile, consumers will be more likely to shop following the hard market. That’s because they’ll be inspired to look for a cheaper plan when they’re asked to pay higher rates at the time of renewal. This phenomenon is already playing out, with drivers requesting 11.8% more new quotes in Q2 2022 than they did in the previous quarter.

Once carriers start working to convert this increase in shopping into new policy sales, the same factors that have hurt our channel this past year will be working in our favor. When insurance brands are in growth mode with an emphasis on direct sales, they’ll want to invest in digital channels like ours that can drive a measurable number of new policy sales. It will also be a plus that our channel can be scaled up quickly as the market becomes more favorable to profitable customer acquisition.

As the leader in our space, we’re well-positioned to be the company our carrier partners trust to help them drive direct online policy sales. We’ve long been an innovator in the way we equip our partners with the deep transparency they need to understand their performance, and carriers know we’ll always do what’s best for their long-term interests.

Recently, our carrier partners have been working with our team to prepare themselves to maximize performance once the hard market ends. Leading brands are experimenting with using our data passing integration to improve their conversion rates, optimizing their performance for customer lifetime value, and using our exchange to monetize non-converting site visitors. Once the market turns around, they’ll be ready to hit the ground running at top speed.

In a cyclical industry, disciplined execution is key

Like our carrier partners, the ongoing hard market cycle has had a significant, negative impact on our business. But also like our carrier partners, we’re well-equipped to enjoy a major growth period coming out of the hard market, in much the same way that we nearly doubled our annual P&C transaction value coming out of the hard market of the mid-2010s.

While we can’t control outside factors like used car prices and vehicle repair costs, we remain committed to the disciplined, consistent execution and the lean corporate structure that enable us to build valuable, lasting relationships with our partners. And when they come out of the hard market ready to grow, we’ll be ready to help them do it.