Life insurance is an industry on the upswing, and a growing group of life insurance consumers are turning to online shopping to find and purchase the policies that are right for them. According to the industry group LIMRA, new, annualized premiums increased by 6% in the second quarter of 2022, marking the sixth consecutive quarter of premium growth. And the group’s 2022 Insurance Barometer report found “a large shift favoring online life insurance shopping and purchasing,” which it attributed to technological advances and behavioral changes stemming from the Covid-19 pandemic.

As online shoppers become a bigger piece of the puzzle for life insurance carriers, it’s important for carrier marketers to gain a deeper understanding of their needs and preferences. That’s why we surveyed 290 consumers who shopped for life insurance online via our owned-and-operated comparison shopping websites during the past 12 months. We asked questions that sought to help us and our carrier partners learn more about the customer acquisition marketplace by revealing how these consumers like to shop and what carriers can do to better support them.

DOWNLOAD OUR FREE SURVEY RESULTS HERE –>

Here are five things we learned about online life insurance shoppers from our survey:

1. Online life insurance shoppers need help understanding their options

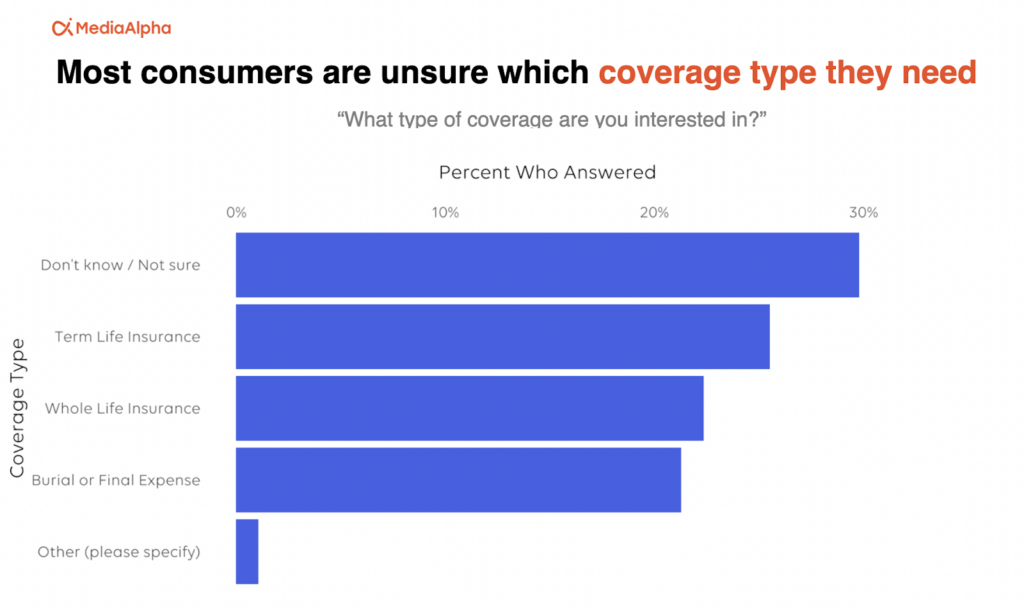

Life insurance can be a complex product, and shoppers need guidance when it comes to understanding what plans work best for them. When we asked what kind of life insurance policy shoppers were looking for, a plurality—30%—said they didn’t know.

Meanwhile, the most common reasons consumers gave for being hesitant to shop online were:

- The inability to ask questions

- The fear that they would make the wrong purchase decision

Some consumers were even unaware that life insurance premiums increase as you age, with 50% of 18-24 year-old shoppers not knowing this vital piece of information.

The takeaway: Life insurance carriers should make it easy for consumers to get the guidance and information they need in their online experiences

Use omni-quote experiences to show shoppers all of their options, rather than targeting shoppers by coverage types they might not understand. You can also give consumers the opportunity to ask questions with a chatbot on your quote page, and by prominently displaying a phone number the shopper can call to speak with an expert.

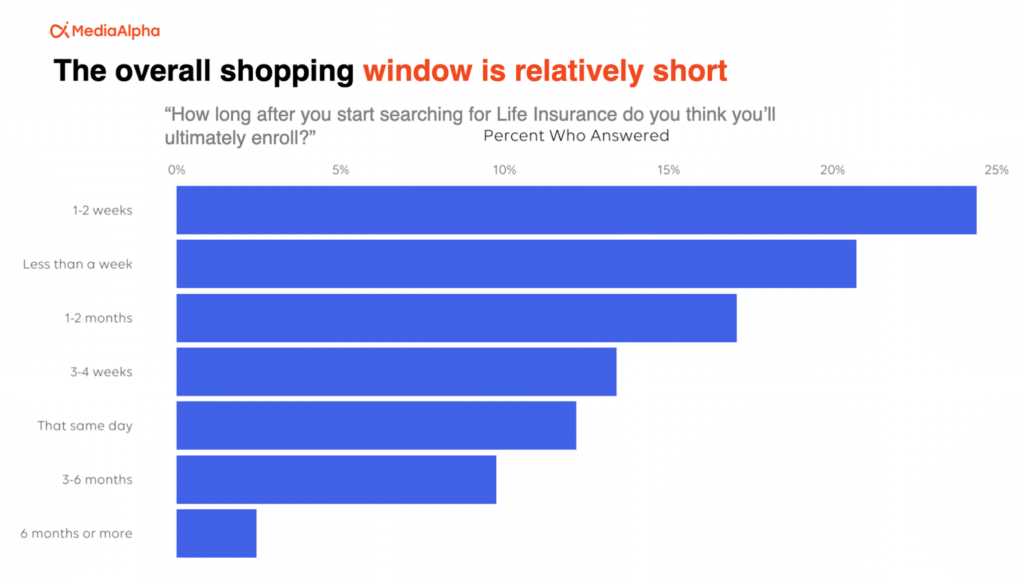

2. The online shopping window is short (about two weeks), but consumers do serious research during it

Fifty-seven percent of consumers said they planned to purchase a life insurance policy within two weeks of beginning their research. In this short window, shoppers do rather intensive research. More than 30% of shoppers said they planned to spend six or more hours gathering information about their options, and more than half said they planned to spend at least three hours researching.

The takeaway: Carriers need to be proactive about reaching shoppers during this two-week, intensive research phase, to ensure they make it into the consideration set

With a purchase cycle this short, consumers are going to move from awareness to interest to consideration fairly quickly. You need to be visible. Brands with high unaided awareness have a leg up here, but even those that are less of a household name can intercept in-market consumers who are near the point of purchase with very targeted media.

Advertising on insurance shopping websites allows you to connect with shoppers as they’re doing their research. And when you buy clicks and leads, make sure you’re sending reminder emails to shoppers within two weeks of their filling out a request for a quote. This way, you don’t miss them during the crucial two-week window.

3. Consumers in the 25-34 year-old demographic are primed to shop for life insurance

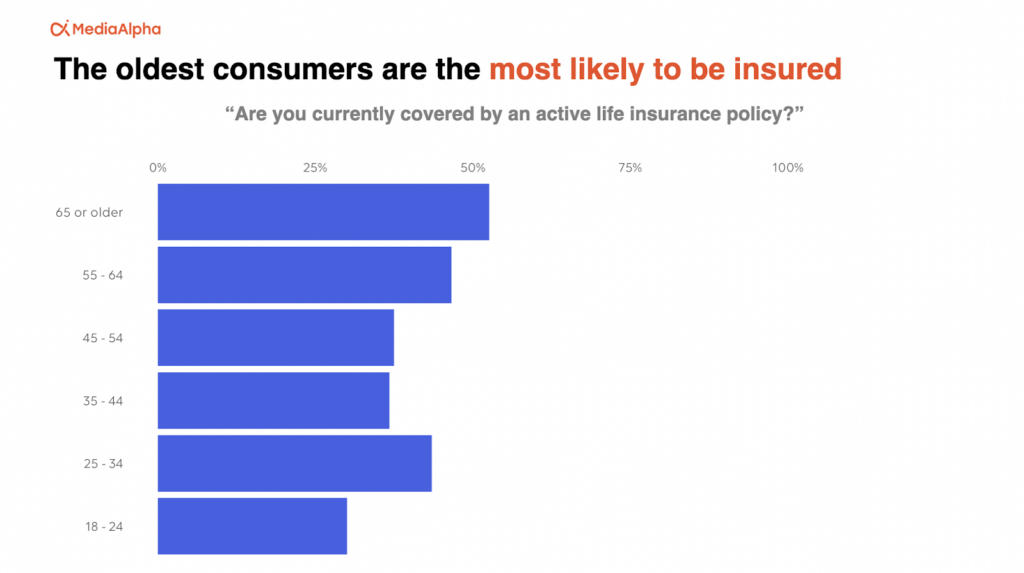

Between the ages of 25 and 34, consumers frequently reach major life milestones that inspire them to think about their long-term financial security, which in turn encourages them to consider life insurance. During this time period, shoppers may get married, have children, or purchase their first home.

As a result, we found that this demographic was more likely to be covered by life insurance than every other demographic besides the 55-64 and 65+ groups.

The takeaway: 25-34 year-old shoppers present a real opportunity for carriers

These 25-34 year-old shoppers are just starting to get their financial lives in order, and they’re thinking long term. While they’re actively looking for the right policy, make sure you’re targeting them and bidding appropriately.

4. Email is the most preferred communications channel for shoppers

Regardless of age or gender, email was the channel consumers most wanted to use when reaching out to a life insurance provider.

However, there was some variation in consumers’ second most preferred channels based on age and gender. Consumers under 45 liked to communicate via text second best, whereas a phone call was the second choice of shoppers over 45. After email, female shoppers said they were equally receptive to a text or a phone call, whereas male shoppers preferred a phone call.

The takeaway: Make sure you have an intelligent email strategy in place

Given email’s prominence, it’s important to develop and execute a strong gameplan for connecting with shoppers via this channel. Make sure you’re segmenting your audience and a/b testing your messaging to ensure that you’re making the most effective pitch to each shopper. Experiment with different email cadences to find the contact schedule that generates the best results.

5. Insurtechs still trail legacy carriers in terms of brand awareness

Over the past several years, a wave of insurtechs have established a foothold in the life insurance customer acquisition marketplace through intelligent media-buying and user-friendly consumer experiences. Yet despite this progress, our survey found that these carriers were still well behind the space’s legacy leaders when it came to aided brand awareness.

For instance, the carrier with the greatest aided brand awareness was MetLife, with more than 60% of respondents saying they’d heard of it. By contrast, the most-well known insurtech was TruStage, which had an aided brand awareness of about 20%.

The takeaway: Insurtechs can overcome the awareness gap by reaching consumers in the consideration phase

A lack of brand awareness is a key weakness for insurtechs when competing against incumbent carriers. However, insurtechs can get around this disadvantage by investing in marketing at the bottom of the funnel. By reaching consumers with an ad right after they finish submitting a request for a quote on an insurance shopping site, you can push your way into their consideration set even if they’ve never heard of you before. From there, it’s up to you to offer the right policy at the right price.

Life insurance shoppers are moving online, and it’s up to carriers to adapt

As life insurance shoppers continue relying on digital channels to find and purchase policies, carriers will need to develop a deeper understanding of their digital audiences and more sophisticated strategies for segmenting, targeting, and acquiring these shoppers.

This means optimizing for important media-buying metrics like lifetime value-to-customer acquisition costs, creating a seamless user experience, and implementing online quoting and binding to streamline the path to purchase.

If you’d like to download our full survey, you can do so here. If you have questions about how to upgrade your digital customer acquisition game, your MediaAlpha account manager will be more than happy to lend some expertise. And if you’re not yet a MediaAlpha client, you can schedule a time to speak with us on our website.